Buying or selling a farm or ranch in Texas is more than just a handshake and a price tag. It needs a good understanding of the Texas Farm and Ranch Contract. The Texas Real Estate Commission (TREC) created this important document. It guides rural property transactions. It ensures transparency and protects the interests of both buyers and sellers.

The contract covers many important topics. These include the sale of land, improvements, and accessories. It also mentions exclusions like mineral rights and water access. For many people, understanding complex clauses can be hard. This includes things like oil and gas lease addendums or natural resource reservations. However, these details are crucial to avoid disputes and safeguard your investment.

In This Article:

- Introduction

- Key Parties and Definitions

- Property Components

- Sales Price and Financing

- Leases and Reservations

- Earnest Money and Option Period

- Title Policy and Survey Requirements

- Property Condition

- Closing and Possession

- Special Provisions

- Expense Allocations

- Tax Considerations

- Casualty Loss

- Default and Remedies

- Mediation and Legal Fees

- Escrow Terms

- Federal Requirements

- Important Notices

- Addenda and Attachments

Introduction

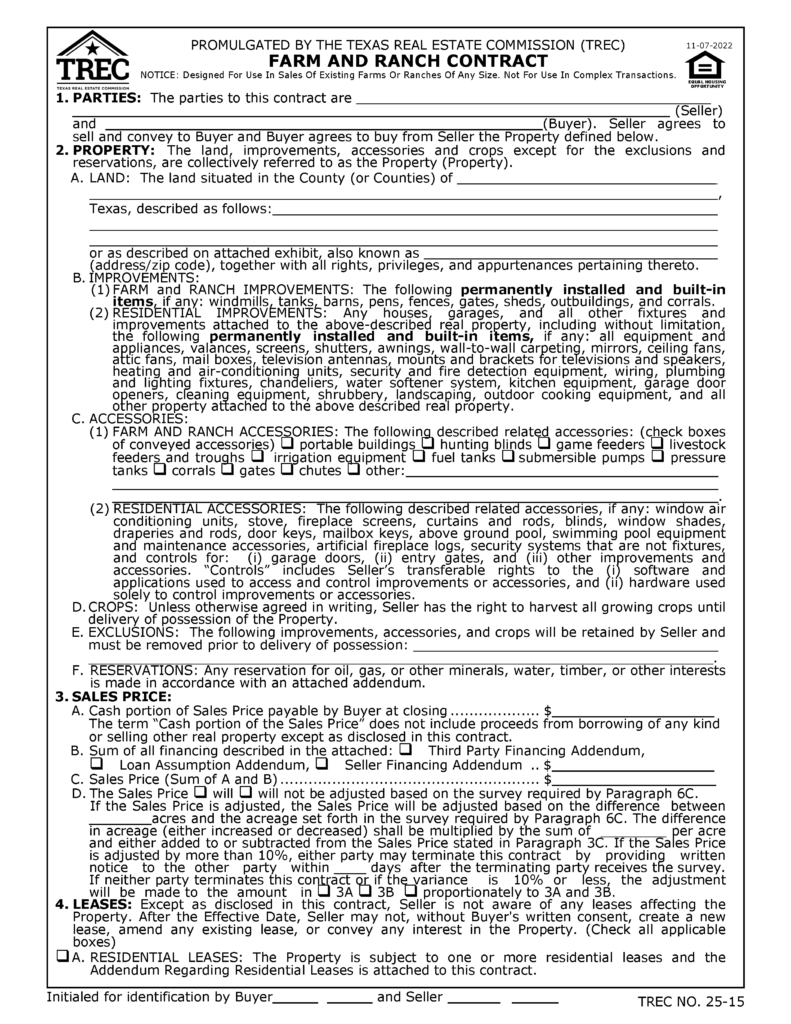

The Texas Farm and Ranch Contract is created by the Texas Real Estate Commission (TREC). It helps people buy and sell rural properties, like farms and ranches. This legal document explains the rights and duties of buyers and sellers. It ensures fairness and transparency in the deal. It is important to understand the main parts of this contract. This knowledge helps you make smart choices and avoid problems when buying or selling.

Key Parties and Definitions

In this part of the contract, the people involved in the deal are named. These are usually the buyer and the seller. It also explains what certain words mean. For example, “property” includes the land and buildings. “Improvements” are things added to the land, like barns or houses. “Accessories” are things that go with the property, like irrigation systems. Knowing what these words mean helps everyone understand what exactly is being bought or sold.

Property Components

Land, Improvements, and Crops

The contract specifies that the sale includes the land and all permanently attached structures, such as barns, fences, and windmills. Residential improvements like houses and garages are also part of the property, along with accessories such as irrigation equipment or livestock feeders. Crops currently growing on the land are typically included, but the seller retains the right to harvest them before possession is transferred unless otherwise agreed. This comprehensive inclusion ensures buyers receive everything necessary for continued use of the property.

Exclusions and Reservations

Sellers have the option to exclude specific items from the sale, such as portable buildings, equipment, or personal belongings. Reservations allow sellers to retain ownership of mineral rights, water rights, or timber, which must be explicitly stated in an addendum. Buyers should carefully review this section to ensure that no critical components are omitted from the transaction.

Sales Price and Financing

The sales price section breaks down the agreed purchase price into its components: the cash portion and any financing arrangements. Buyers can use third-party financing, loan assumptions, or seller financing to fulfill the purchase price. Additionally, the contract allows for adjustments based on a survey of the property’s actual acreage. For example, if the surveyed acreage differs significantly from what was initially stated, the price may be recalculated to reflect the difference.

Leases and Reservations

Leases impacting the property, such as grazing, hunting, or agricultural leases, must be disclosed by the seller. This includes common gas lease addendum agreements that specify terms for mineral rights and surface usage. Residential leases and fixture leases, such as those for propane tanks or solar panels, are also addressed. Natural resource leases, including oil and gas agreements, are particularly significant in the state of Texas oil and gas leases. Buyers should carefully review these leases and any relevant oil and gas lease addendum documents to fully understand ongoing obligations or benefits that may affect the property’s use or value.

Earnest Money and Option Period

This section explains the financial commitments required to secure the contract. Buyers must deposit earnest money, demonstrating their intent to purchase, and pay an option fee to retain the unrestricted right to terminate the contract during a specific option period. This period is invaluable for conducting inspections and addressing concerns. If the buyer terminates the agreement during the option period, the earnest money is typically refunded, but the option fee is retained by the seller.

Title Policy and Survey Requirements

The title policy protects the buyer against issues such as liens, boundary disputes, or encumbrances on the property. Sellers are required to provide a title commitment within a specified period, giving buyers an opportunity to review and raise objections. Similarly, surveys are crucial for confirming property boundaries and identifying any potential discrepancies. Addressing these concerns early ensures a smoother transaction and minimizes legal risks.

Property Condition

Buyers have the right to inspect the property and accept it in its “As Is” condition or negotiate specific repairs. Sellers are obligated to disclose known defects, environmental hazards, or prior flooding issues. The inclusion of a detailed inspection period allows buyers to make informed decisions and request necessary repairs or adjustments to the contract terms.

Closing and Possession

During the closing phase, both parties fulfill their contractual obligations, including the transfer of funds, signing of documents, and delivery of a general warranty deed. The contract also addresses the transfer of possession, ensuring that buyers receive access codes and operational instructions for smart devices, if applicable. Sellers must vacate the property unless an alternative agreement, such as a temporary lease, is in place.

Special Provisions

The special provisions section allows for the inclusion of additional terms or disclosures. These must be factual statements or instructions that do not modify the contract’s standard terms. For instance, sellers might include specific instructions regarding the transfer of warranties or ongoing obligations related to property maintenance.

Expense Allocations

This section delineates financial responsibilities between the buyer and seller. Sellers are typically responsible for expenses like title preparation and lien releases, while buyers cover appraisal fees, loan origination charges, and inspection costs. Clear allocation of expenses helps avoid disputes and ensures a smooth closing process.

Tax Considerations

Property taxes for the current year are prorated between the buyer and seller. Additionally, rollback taxes may apply if the property’s use changes after closing, resulting in penalties or additional taxes. Both parties should be aware of these potential liabilities to prepare adequately.

Casualty Loss

If the property is damaged by fire or other events before closing, the seller is responsible for restoring it to its original condition. Buyers may choose to terminate the contract, extend the closing date, or accept the property in its damaged state with an assignment of insurance proceeds. These provisions safeguard both parties in unforeseen circumstances.

Default and Remedies

In the event of a default, remedies are available to the non-defaulting party. Buyers may enforce specific performance or terminate the contract and recover their earnest money. Similarly, sellers can pursue damages or terminate the agreement if the buyer fails to comply. These clauses provide a clear framework for resolving disputes.

Mediation and Legal Fees

The contract encourages mediation as a first step in resolving disputes. If legal action is necessary, the prevailing party is entitled to recover reasonable attorney fees and court costs. This provision promotes fairness and discourages frivolous lawsuits.

Escrow Terms

Escrow agents play a pivotal role in holding funds and documents until all contract conditions are met. This section outlines their responsibilities and the procedures for disbursing earnest money in case of termination or completion of the transaction.

Federal Requirements

Sellers who are foreign persons must comply with the Foreign Investment in Real Property Tax Act (FIRPTA) by withholding a portion of the sales proceeds for tax purposes. Additionally, agricultural properties owned by foreign entities must be reported under the Agriculture Foreign Investment Disclosure Act (AFIDA). Buyers should consult legal and tax professionals to navigate these regulations.

Important Notices

The contract includes various notices to inform buyers of potential issues, such as annexation, water level fluctuations, and public improvement districts. These disclosures help buyers make informed decisions and understand the property’s unique characteristics.

Addenda and Attachments

Common addenda, such as those for financing, mineral reservations, or property owners’ associations, are attached to the contract to provide additional terms and disclosures. Buyers should review these carefully to ensure all relevant details are included in the agreement.

Conclusion

Understanding the Texas Farm and Ranch Contract is an essential step when buying or selling rural property in Texas. It’s more than a stack of papers—it’s a tool that protects your investment, your peace of mind, and your future plans. Whether you’re looking to sell inherited land, purchase a working ranch, or invest in Texas farmland, knowing what this contract covers makes all the difference.

If you’re planning a rural property transaction, it’s wise to work with a real estate professional who knows how to navigate the Texas Farm and Ranch Contract. Taking the time to learn about each section of the contract ensures that your deal is smooth, fair, and legally sound. When you’re ready to take the next step—whether buying or selling a farm or ranch in Texas—reach out to a Daughtrey Law Firm to guide you with care and confidence.

Frequently Asked Questions (FAQs)

What is the Texas Farm and Ranch Contract used for?

The Texas Farm and Ranch Contract is a legal agreement created by the Texas Real Estate Commission (TREC). It is used when people buy or sell rural land in Texas, including farms, ranches, and country properties. This contract explains everything involved in the sale, such as what is included with the land, how payments will be made, and how both parties are protected.

Do I need a real estate agent to use the Texas Farm and Ranch Contract?

While it’s not required by law, using a real estate agent is highly recommended. Real estate professionals understand the Texas Farm and Ranch Contract in detail. They can explain each part clearly and help you avoid costly mistakes. Whether you’re buying a ranch or selling rural property, an experienced agent helps make the process smoother and safer.

What are mineral rights in a Texas land sale?

Mineral rights refer to the ownership of underground resources like oil, gas, or minerals. In Texas, a seller can keep these rights when selling the land. This is called a mineral reservation. It’s important to check the contract and any addendum to see if mineral rights are included in your purchase or if the seller is keeping them.

What is included in “improvements and accessories”?

Improvements include permanent structures like homes, barns, and fences. Accessories are things that come with the land, such as water pumps, irrigation systems, or livestock feeders. These are listed in the Texas Farm and Ranch Contract so buyers know what stays with the property after the sale.

Can a seller keep the crops on the land after selling?

Yes, in many cases the seller has the right to harvest crops even after the land is sold. This is usually agreed upon in the contract. If nothing is said, the crops may transfer to the new owner. Always check the terms in the Farm and Ranch Contract to understand what stays and what goes.

How does the option period help a buyer?

The option period gives the buyer time to inspect the property and think about their decision. During this time, the buyer can cancel the deal for any reason. This helps protect the buyer from buying a property that has hidden problems. The option period is a key part of the Texas rural property buying process.

What if there is damage to the property before closing?

If the property is damaged by fire, storms, or other causes before the sale is final, the seller must fix the damage. The buyer can also choose to cancel the deal, wait for repairs, or accept the property as-is and get the insurance money. These rules are written in the Texas Farm and Ranch Contract to protect both sides.

What is a title policy and why do I need one?

A title policy is like insurance for the property’s ownership. It makes sure no one else has a legal claim to the land, such as old liens or ownership disputes. In Texas farm and ranch transactions, the title policy helps buyers avoid legal trouble after buying the land. The seller usually pays for this policy unless the contract says otherwise.

How are property taxes handled at closing?

Property taxes are usually split between the buyer and seller based on how many days each person owned the land during the year. These are called prorated taxes. In some cases, special taxes like rollback taxes might apply if the use of the land changes. These tax rules are explained in the Texas Farm and Ranch Contract.

Are there special rules for foreign sellers?

Yes, if the seller is not a U.S. citizen or resident, special tax laws may apply. Under FIRPTA, part of the sale money may be held back for taxes. Also, foreign owners of Texas farmland may need to report their property under AFIDA. These rules make sure all tax and legal steps are followed when selling farm and ranch land in Texas.