Buying land in Texas is an exciting adventure. However, it can also bring its own challenges after you sign the contract. Errors in property titles and misunderstandings about property taxes can become hurdles that confuse buyers and impact their finances. This blog will help you understand title corrections and property tax changes after a real estate deal in Texas. We’ll break down the essential steps and provide you with actionable insights to navigate these complex issues confidently.

In This Article:

Understanding Title Corrections After Closing

What is a Title Correction?

A title correction refers to the process of rectifying errors in the property title. Think of a title as a report card for your land; it shows who owns it and any associated claims. Accuracy in this document is crucial for establishing clear ownership and avoiding future disputes. Even minor errors, if left unaddressed, can create significant problems for property owners when they decide to sell or refinance.

Common Title Errors in Real Estate Transactions

Some common mistakes seen in real estate transactions include:

- Misspelled names

- Incorrect property descriptions

- Discrepancies regarding ownership

Each of these errors can lead to complications down the line, such as delays in future transactions or challenges in asserting your rights over the property. Addressing these mistakes promptly is essential to maintain a clear title and prepare for any real estate dealings.

Steps to File a Title Correction

If you discover an error in your title, follow these steps to initiate a correction:

- Find the Mistake: Carefully review your title documents to identify the errors present.

- Gather Information: Collect all necessary documents, including the original title deed.

- Fill Out Forms: Complete the required forms to officially request a title correction.

- Submit the Forms: Deliver the completed forms to the appropriate county office.

- Consult an Attorney: Engaging with a real estate lawyer can ensure all procedures are followed correctly.

Managing Property Tax Adjustments Post-Closing

Understanding Property Tax Adjustments

After purchasing property, it’s essential to understand that you may need to make adjustments to the property taxes based on the terms of the sale. This involves assessing how much tax liability falls on you as the new owner. Property tax adjustments may be necessary to reflect changes in ownership and value estimated for the tax year.

How to Calculate Property Tax Adjustments

To accurately determine your property tax adjustments, consider the following steps:

- Review your purchase price along with the previous owner’s tax bill to create a benchmark.

- Check any agreements specified in your sale contract about tax obligations.

- Divide the taxes according to how long you owned the property in the current tax year.

Understanding these factors will help you manage your tax responsibilities effectively and avoid unexpected financial burdens.

Filing for Property Tax Adjustments: Step-by-Step

To file for tax adjustments, adhere to these structured steps:

- Collect Documents: Ensure you have your sale agreement and the relevant tax bills on hand.

- Fill Out Forms: Prepare the necessary forms that your local tax office requires to request adjustments.

- Submit on Time: Be aware of deadlines and make sure to submit your forms to the local tax office promptly.

- Keep Copies: Always retain copies of everything you send for your personal records.

Addressing Deferred Maintenance Issues

What are Deferred Maintenance Issues?

Deferred maintenance refers to repairs that have been postponed, potentially leading to larger issues after a sale. For new property owners, awareness of these issues is vital, as they could significantly impact property value and livability.

Legal Obligations for Sellers and Buyers

It is the seller’s responsibility to disclose any known issues with the property, while buyers should conduct thorough inspections prior to closing. Both parties must understand their legal obligations to avoid disputes related to deferred maintenance.

Steps to Resolve Deferred Maintenance Issues

To address any deferred maintenance problems, consider these approaches:

- Communicate: Reach out to the other party to discuss any issues discovered.

- Negotiate: Collaborate to find a resolution, such as adjusting the sale price or agreeing on repairs.

- Consider Legal Help: If needed, look into legal advice to assist in resolving disputes effectively.

Importance of Legal Guidance in Real Estate Transactions

Why Invest in Expert Legal Representation?

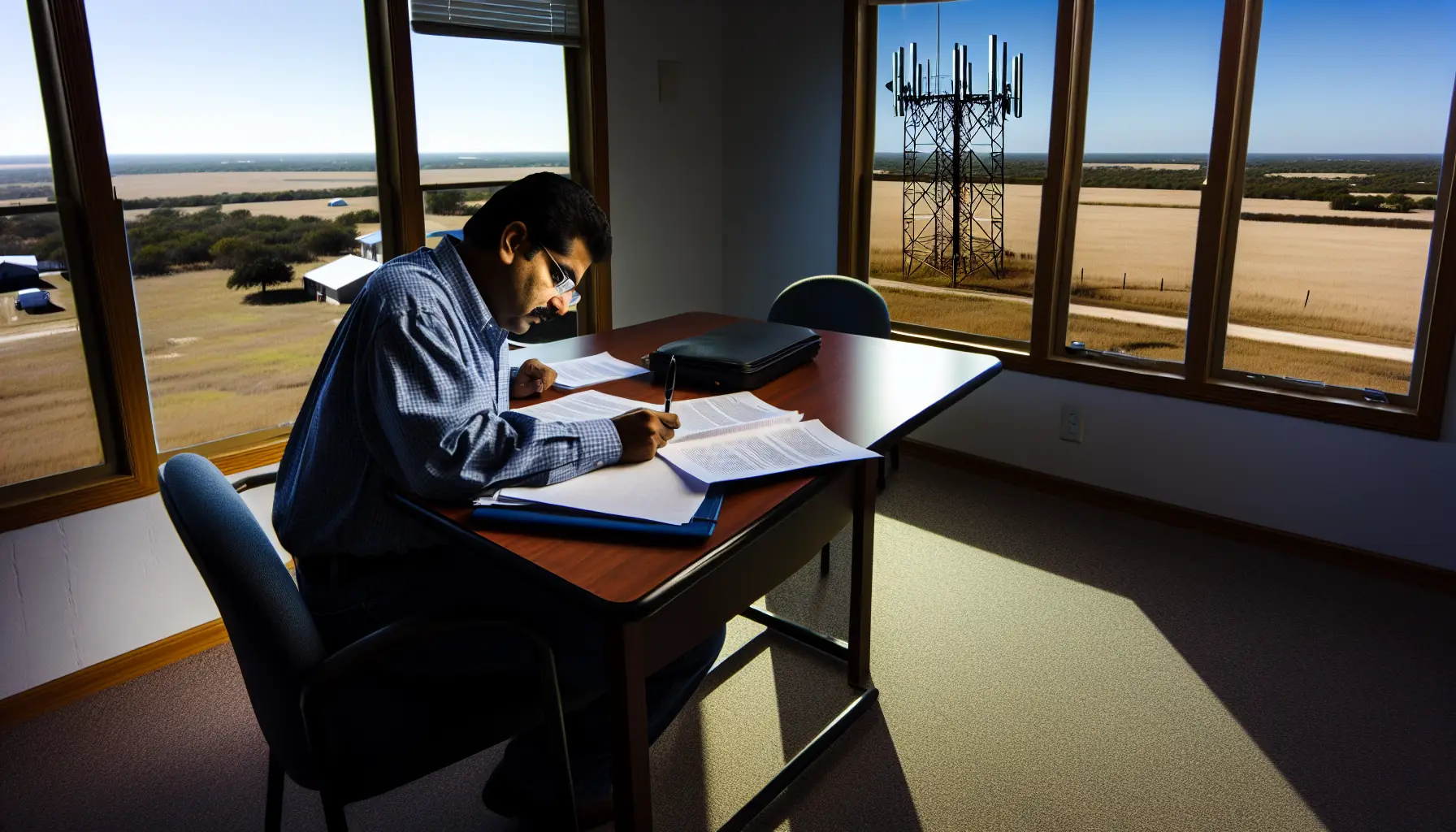

Hiring a legal expert who specializes in real estate can be very helpful for anyone in this complex area. These professionals are well-versed in the complex regulations and extensive paperwork that often accompany real estate transactions. Their wealth of experience allows them to identify and prevent common pitfalls that many individuals may encounter. Having a knowledgeable Texas legal expert with you can help your transactions go smoothly. This will protect your investments and give you peace of mind during the process.

Conclusion

In summary, it’s important to know how to fix title errors. You also need to handle property tax changes. This knowledge helps make real estate deals go smoothly. Proper legal advice can significantly aid you in tackling these issues and ensuring the safety of your investments. If you need help with title corrections or property tax adjustments, Daughtrey Law Firm is here to assist you.